[ad_1]

Getty Images

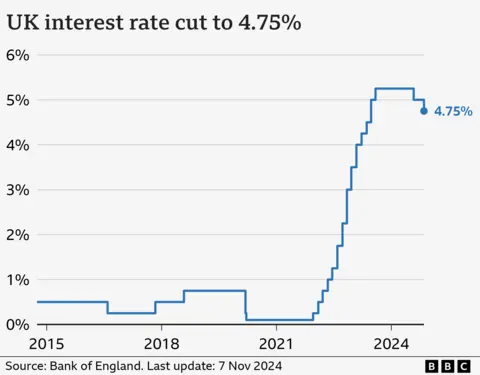

Getty ImagesUK interest rates could take longer to fall after the Bank of England forecast that inflation will creep higher again.

It said while last week’s Budget will initially boost economic growth and cut unemployment, measures such as raising the cap on bus fares and VAT on private school fees will push prices up at a faster rate.

The Bank cut interest rates to 4.7% from 5% in a move than had been widely expected.

Bank governor Andrew Bailey said rates were likely to “continue to fall gradually from here”, but cautioned they could not be cut “too quickly or by too much”.

Inflation – which measures the pace of price rises – fell below the Bank’s 2% target in the year to September, but was always expected to rise again after gas and electricity prices rose last month.

It was then forecast to drop back to 2% by 2026, but the Bank now expects that to happen in the following year.

Last week, the Labour government’s Budget included plans to borrow an average of £28bn a year, as well as £40bn in tax-raising measures.

The biggest measure is an increase in National Insurance Contributions paid by employers.

The Bank said that this would have a small impact on inflation. Businesses are expected to pass on the cost of higher National Insurance costs to customers by raising prices.

It could also result in a slower pace of wage rises for employees.

The Bank also revised up its growth forecast for 2025 and suggested that the rate of unemployment could fall sharply to 4.1% from 4.7%.

[ad_2]

Source link